Get information about banking providers

Use the payment providers endpoints to get information about what functionalities different banking providers support.

Each banking provider that users can use to make a payment has a provider id associated with it. Each provider supports different regions, types of payment and authorisation flows.

Getting information about providers and their IDs can be useful in a variety of situations:

- Deciding what filters to apply to a

user_selectedpayment, to change the providers users can select from. - Finding the correct

idto use in a preselected payment as part of your returning user payment flow. - As part of building your own provider selection screen if you build your own authorisation UI.

We recommend that you use the v3/payment-providers/search endpoint to get information about providers.

You can also get information about providers by:

- Starting the payment authorisation flow in a direct API integration.

- Checking the Providers page in Console.

The information that /v3/payment-providers/search returns

/v3/payment-providers/search returnsRegardless of whether you retrieve data for a single provider or a list, the response contains the following information for each provider:

| Name of object | Description |

|---|---|

id | The id for the provider, which you need to provide for a preselected payment, or the provider-selection action in a direct API integration. |

display_name | The display name for the provider. This is what you should display to the customer in your payment UI. |

icon_uri | The logo of the provider, with no text. You can display this to the customer in your payment UI. The format of the icon depends on what value you provide in the |

logo_uri | The logo of the provider, with the provider name as text beneath it. You can display this to the customer in your payment UI. |

bg_color | The recommended background colour, as a hex code, to display for the provider on the selection screen. |

country_code | The country that the provider is in. |

swift_code | The SWIFT code for the provider. |

capabilities | The capabilities that the provider supports for both payments and mandates. This includes whether the provider is currently available and the payment scheme it supports. If you include your |

release_channel | The release channel, or maturity, of the provider, which can be By default, Many providers across Europe are in the |

availability | Whether the provider is currently available (healthy), or experiencing downtime (unhealthy). Also includes the time at which the API checked the provider's availability. |

schemes | The payment schemes that the provider supports. For each scheme, this also include the currencies it supports, and whether it accepts payments with SCAN or IBAN. |

bin_ranges | A list of BIN (Bank Identification Numbers) ranges the provider supports. The BIN refers to the first eight numbers on a payment card, which identify the financial institution that issues the card. |

Displaying these elements in a UIThis table makes reference to the need for you to display things to customers. Note that if you use a TrueLayer web or mobile authorisation UI, such as the HPP, Web SDK or a mobile SDK, these values are used for that, with no extra work required.

This is an example of the format of a response from the v3/payment-providers/search endpoint:

{

"items": [

{

"id": "mock-payments-gb-redirect",

"display_name": "Mock UK Payments - Redirect Flow",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/uk/icons/mock-payments-gb-redirect.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/uk/logos/mock-payments-gb-redirect.svg",

"bg_color": "#FFFFFF",

"country_code": "GB",

"swift_code": "MOCKGB05XXX",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "general_availability",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-10-26T14:35:05.8619321"

},

"schemes": [

{

"id": "faster_payments_service",

"requirements": [

{

"currencies": [

"GBP"

],

"account_identifier_types": [

"sort_code_account_number"

]

}

]

}

]

}

}

}

}

]

}Specify the providers that the endpoint returns

To retrieve a list of different providers, the provider_id for each of them, and their capabilities, make a POST request to the v3/payment-providers/search endpoint.

There are five main parameters that you need to configure when you make a request to the v3/payment-providers/search endpoint:

You can also optionally configure:

Country parameter

Use the countries parameter at the start of your request to determine the countries that you want to return banking providers for. The endpoint supports the following ISO 3166 country codes:

| Country code | AT | BE | DE | DK | ES | FI | FR | GB | IE | IT | LT | NL | NO | PL | PT | RO |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Country | Austria | Belgium | Germany | Denmark | Spain | Finland | France | United Kingdom | Ireland | Italy | Lithuania | The Netherlands | Norway | Poland | Portugal | Romania |

Note that the release_channel you specify in the capabilities also impacts this, as some countries only have providers in private_beta.

Currency parameter

Different providers support different payment schemes. Use the currencies parameter to return only providers that support schemes which support certain currencies. The available currencies are: GBP, EUR, PLN, and NOK.

In the UK, all payments are made over the faster_payments_scheme, an instant payment scheme.

In Europe, payments typically use either the sepa_credit_transfer_instant or sepa_credit_transfer payment schemes.

Customer segment parameter

Each banking provider is classified to serve one or more of the following three customer segments: retail, business, or corporate. Use the customer_segment parameter to specify whether the endpoint should return providers that cater to individual, business, or corporate customers respectively.

To use this parameter, specify the providers you want to return in an array.

If you don't include the

customer_segmentparameter, only retail banking providers are returned by default. To view the full list of possible banking providers, you need to include thebusinessandcorporatevalues for this filter.

Capabilities parameter

You can filter by the capabilities of a provider. This refers to whether they support one or both of:

- Single

paymentsviabank_transfer. - Variable recurring payments made over a

mandate, forvrp_sweepingorvrp_commercial.

This filter ensures that a provider supports the payment functionalities you provide in the capabilities. However, it doesn't exclude other functionalities. As such, if you filter to include mandates, but don't include payments, the response may still include providers that support both. However the response won't include providers that only support payments.

Authorisation flow parameter

Different providers support different authorisation flows. For example, certain providers might require the user be redirected to them to authorise a payment, or others that the user provide their IBAN through a text field.

You can use the provider_selection, redirect, form and consent parameters to return providers with specific auth flow requirements. If you include one of these parameters, the response includes providers that require these authorisation flow considerations.

These filters follow the same logic as the /v3/payments/{id}/authorization-flow endpoint used in a direct API integration.

provider_selection parameter

provider_selection parameterYou can include the authorization_flow.configuration.provider_selection.icon.type parameter in your request to determine the type of icon the endpoint returns. There are 5 different formats of icon you can choose from:

default: The bank logo in SVG format with no background.extended: The bank logo in SVG format with a solid background colour.extended_small: The bank logo in JPEG format with a solid background colour with 192x192px dimensions.extended_medium: The bank logo in JPEG format with a solid background colour with 432x432px dimensions.extended_large: The bank logo in JPEG format with a solid background colour with 864x864px dimensions.

redirect parameter

redirect parameterYou can include the authorization_flow.configuration.redirect parameter in your request. This means the response includes providers where you redirect the user to the provider to authorise the payment.

form parameter

form parameterYou can include up to three different values in the authorization_flow.configuration.form.input_types parameter as an array. If you do this, the response includes providers that require those types of input from the user in order to authorise the payment.

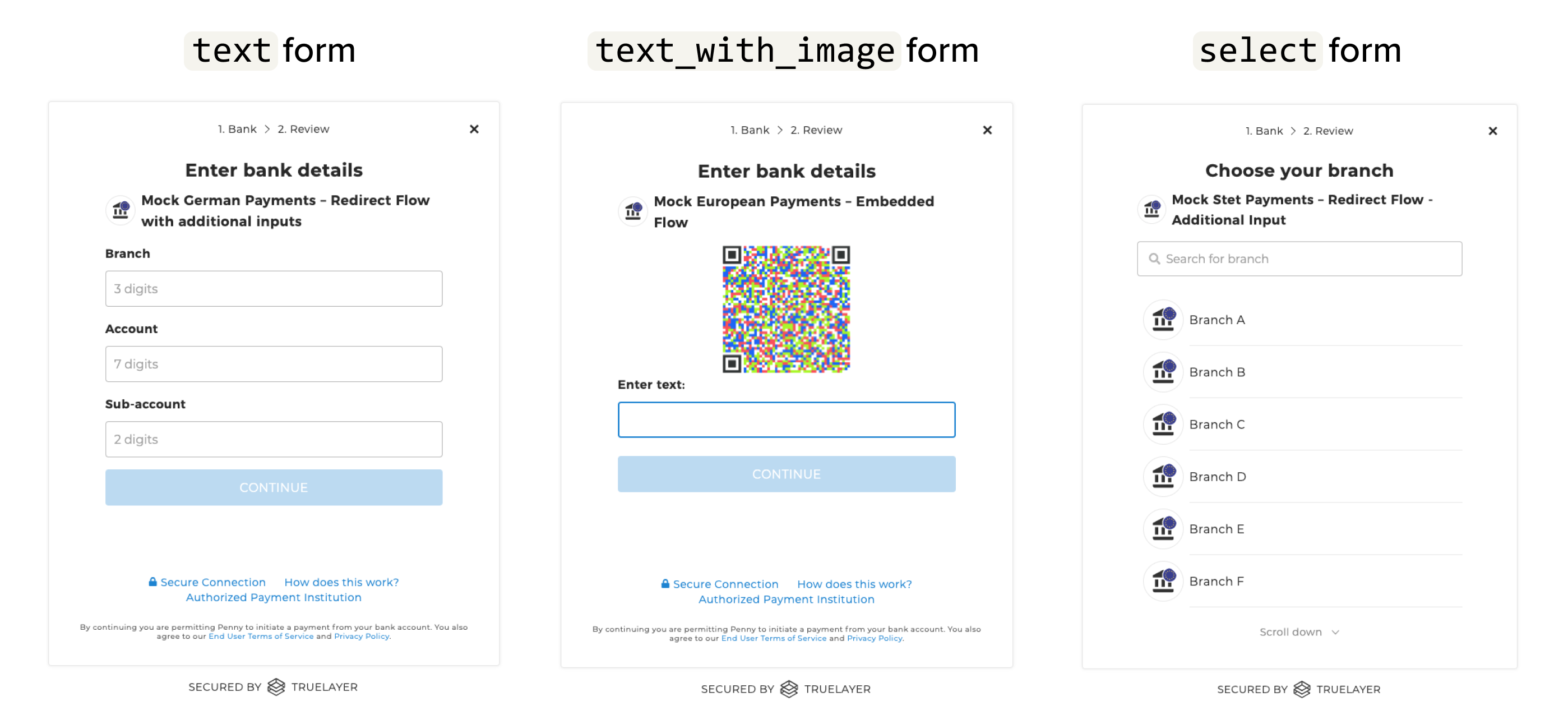

These are the three different input_types for the form action that you can include in the input_types array, to change the providers returned.

text: Returns providers that need the user to enter text, such as IBAN or branch code, to authorise the payment.text_with_image: Returns providers that need the user to enter text based on an image, such as a QR code, to authorise the payment.select: Returns providers that need the user to make a selection from a range of options, such as a branch, to authorise the payment.

The image below shows how these forms display on the embedded payment page (with a German provider).

Example UIs for each type of form a provider can require for authorisation.

If you don't use a prebuilt TrueLayer UI, you can develop your own user interface for user authorisation. In this case, your provider selection and authorisation flow needs to be able to accommodate such inputs for users to make payments through these providers.

consent parameter

consent parameterThe consent filter is optional, and can be omitted from your provider search. However, if you include the consent parameter, your response includes providers that support a step at which you provide explicit user consent for TrueLayer to initiate a payment for them.

Release channel parameter

To filter by all the providers in a specific release channel, add a release_channel object to the request. You can filter by:

general_availabilitypublic_betaprivate_beta

If you do not include a release_channel object in your request, you will receive only providers in general availability in the response.

Many providers across Europe are in the

public_betaorprivate_betarelease channel. Consider this when building your payment creation request, to ensure that providers display for the payment country. You can check the release channel of providers in Console.

Examples of requests with different parameters

There are many ways you can filter the providers you receive with the v3/payment-providers/search endpoint. These examples highlight a few different methods.

UK sweeping redirect only example

This example is a request that returns all providers for the UK that support:

- Both sweeping and commercial VRP

- Only the redirect authorisation method

{

"countries": [

"GB"

],

"currencies": [

"GBP"

],

"customer_segments": [

"retail"

],

"capabilities": {

"payments": {},

"mandates": {

"vrp_sweeping": {},

"vrp_commercial": {}

}

},

"authorization_flow": {

"configuration": {

"redirect": {}

}

}

}{

"items": [

{

"id": "ob-lloyds",

"display_name": "Lloyds",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/icons/lloyds.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/logos/lloyds.svg",

"bg_color": "#00553e",

"country_code": "GB",

"swift_code": "LOYDGB2L",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "general_availability",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:33:04.3284196"

},

"schemes": [

{

"id": "faster_payments_service",

"requirements": [

{

"currencies": [

"GBP"

],

"account_identifier_types": [

"sort_code_account_number"

]

}

]

}

]

}

},

"mandates": {

"vrp_sweeping": {

"release_channel": "general_availability"

}

}

}

},

{

"id": "ob-bos",

"display_name": "Bank of Scotland",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/uk/icons/bos.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/uk/logos/bos.svg",

"bg_color": "#05286a",

"country_code": "GB",

"swift_code": "BOFSGBS1",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "general_availability",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:33:04.3284196"

},

"schemes": [

{

"id": "faster_payments_service",

"requirements": [

{

"currencies": [

"GBP"

],

"account_identifier_types": [

"sort_code_account_number"

]

}

]

}

]

}

},

"mandates": {

"vrp_sweeping": {

"release_channel": "general_availability"

}

}

}

},

{

"id": "ob-santander",

"display_name": "Santander",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/icons/santander.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/logos/santander.svg",

"bg_color": "#EC0000",

"country_code": "GB",

"swift_code": "ABBYGB2LXXX",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "general_availability",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:33:04.3284196"

},

"schemes": [

{

"id": "faster_payments_service",

"requirements": [

{

"currencies": [

"GBP"

],

"account_identifier_types": [

"sort_code_account_number"

]

}

]

}

]

}

},

"mandates": {

"vrp_sweeping": {

"release_channel": "general_availability"

}

}

}

},

{

"id": "ob-barclays",

"display_name": "Barclays",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/icons/barclays.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/logos/barclays.svg",

"bg_color": "#007EB6",

"country_code": "GB",

"swift_code": "BARCGB22",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "general_availability",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:33:04.3284196"

},

"schemes": [

{

"id": "faster_payments_service",

"requirements": [

{

"currencies": [

"GBP"

],

"account_identifier_types": [

"sort_code_account_number"

]

}

]

}

]

}

},

"mandates": {

"vrp_sweeping": {

"release_channel": "general_availability"

}

}

}

},

{

"id": "ob-hsbc",

"display_name": "HSBC",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/icons/hsbc.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/logos/hsbc.svg",

"bg_color": "#515358",

"country_code": "GB",

"swift_code": "MIDLGB22",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "general_availability",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:33:04.3284196"

},

"schemes": [

{

"id": "faster_payments_service",

"requirements": [

{

"currencies": [

"GBP"

],

"account_identifier_types": [

"sort_code_account_number"

]

}

]

}

]

}

},

"mandates": {

"vrp_sweeping": {

"release_channel": "general_availability"

}

}

}

},

{

"id": "ob-first-direct",

"display_name": "first direct",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/uk/icons/first-direct.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/uk/logos/first-direct.svg",

"bg_color": "#626268",

"country_code": "GB",

"swift_code": "MIDLGB22",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "general_availability",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:33:04.3284196"

},

"schemes": [

{

"id": "faster_payments_service",

"requirements": [

{

"currencies": [

"GBP"

],

"account_identifier_types": [

"sort_code_account_number"

]

}

]

}

]

}

},

"mandates": {

"vrp_sweeping": {

"release_channel": "general_availability"

}

}

}

},

{

"id": "ob-rbs",

"display_name": "Royal Bank of Scotland",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/icons/rbs.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/logos/rbs.svg",

"bg_color": "#0A2F64",

"country_code": "GB",

"swift_code": "RBOSGB2L",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "general_availability",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:33:04.3284196"

},

"schemes": [

{

"id": "faster_payments_service",

"requirements": [

{

"currencies": [

"GBP"

],

"account_identifier_types": [

"sort_code_account_number"

]

}

]

}

]

}

},

"mandates": {

"vrp_sweeping": {

"release_channel": "general_availability"

},

"vrp_commercial": {

"release_channel": "general_availability"

}

}

}

},

{

"id": "ob-nationwide",

"display_name": "Nationwide",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/uk/icons/nationwide.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/uk/logos/nationwide.svg",

"bg_color": "#002878",

"country_code": "GB",

"swift_code": "NAIAGB21",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "general_availability",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:33:04.3284196"

},

"schemes": [

{

"id": "faster_payments_service",

"requirements": [

{

"currencies": [

"GBP"

],

"account_identifier_types": [

"sort_code_account_number"

]

}

]

}

]

}

},

"mandates": {

"vrp_sweeping": {

"release_channel": "general_availability"

}

}

}

},

{

"id": "ob-ulster",

"display_name": "Ulster Bank",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/icons/ulster.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/logos/ulster.svg",

"bg_color": "#0a2f64",

"country_code": "GB",

"swift_code": "ULSBGB2B",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "general_availability",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:33:04.3284196"

},

"schemes": [

{

"id": "faster_payments_service",

"requirements": [

{

"currencies": [

"GBP"

],

"account_identifier_types": [

"sort_code_account_number"

]

}

]

}

]

}

},

"mandates": {

"vrp_sweeping": {

"release_channel": "general_availability"

},

"vrp_commercial": {

"release_channel": "general_availability"

}

}

}

},

{

"id": "ob-halifax",

"display_name": "Halifax",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/uk/icons/halifax.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/uk/logos/halifax.svg",

"bg_color": "#0040bb",

"country_code": "GB",

"swift_code": "HLFXGB22",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "general_availability",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:33:04.3284196"

},

"schemes": [

{

"id": "faster_payments_service",

"requirements": [

{

"currencies": [

"GBP"

],

"account_identifier_types": [

"sort_code_account_number"

]

}

]

}

]

}

},

"mandates": {

"vrp_sweeping": {

"release_channel": "general_availability"

}

}

}

},

{

"id": "ob-natwest",

"display_name": "NatWest",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/icons/natwest.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/logos/natwest.svg",

"bg_color": "#42145f",

"country_code": "GB",

"swift_code": "NWBKGB2L",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "general_availability",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:33:04.3284196"

},

"schemes": [

{

"id": "faster_payments_service",

"requirements": [

{

"currencies": [

"GBP"

],

"account_identifier_types": [

"sort_code_account_number"

]

}

]

}

]

}

},

"mandates": {

"vrp_sweeping": {

"release_channel": "general_availability"

},

"vrp_commercial": {

"release_channel": "general_availability"

}

}

}

}

]

}Europe corporate and business example

This example is a request that returns all providers for Europe that serve the corporate and business customer segments. All other parameters are set to return as many providers as possible. Most providers serve the retail segment, so the response only returned two providers.

{

"countries": [

"AT", "BE", "DE", "DK", "ES", "FI", "FR", "IE", "IT", "LT", "NL", "PT", "RO"

],

"currencies": [

"EUR"

],

"customer_segments": [

"corporate", "business"

],

"capabilities": {

"payments": {

"bank_transfer": {}

},

"mandates": {

"vrp_sweeping": {},

"vrp_commercial": {}

}

},

"authorization_flow": {

"configuration": {

"redirect": {},

"form": {

"input_types": [

"text"

]

},

"consent": {

"requirements": {

"pis": {},

"ais": {

"scopes": [

"accounts"

]

}

}

}

}

}

}{

"items": [

{

"id": "stet-bnp-paribas-ma-banque",

"display_name": "BNP Paribas",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/fr/icons/bnp-paribas-mabanque.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/fr/logos/bnp-paribas-mabanque.svg",

"bg_color": "#238D57",

"country_code": "FR",

"swift_code": "BNPAFRPPXXX",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "public_beta",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:59:02.6771207"

},

"schemes": [

{

"id": "sepa_credit_transfer",

"requirements": [

{

"currencies": [

"EUR"

],

"account_identifier_types": [

"iban"

]

}

]

},

{

"id": "sepa_credit_transfer_instant",

"requirements": [

{

"currencies": [

"EUR"

],

"account_identifier_types": [

"iban"

]

}

]

}

]

}

}

}

},

{

"id": "stet-credit-mutuel",

"display_name": "Crédit Mutuel",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/fr/icons/credit-mutuel.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/fr/logos/credit-mutuel.svg",

"bg_color": "#E9E4E1",

"country_code": "FR",

"swift_code": "CMCIFR2AXXX",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "public_beta",

"availability": {

"recommended_status": "healthy",

"updated_at": "2023-11-02T15:59:02.6771207"

},

"schemes": [

{

"id": "sepa_credit_transfer",

"requirements": [

{

"currencies": [

"EUR"

],

"account_identifier_types": [

"iban"

]

}

]

},

{

"id": "sepa_credit_transfer_instant",

"requirements": [

{

"currencies": [

"EUR"

],

"account_identifier_types": [

"iban"

]

}

]

}

]

}

}

}

}

]

}Germany embedded authorisation example

This example is a request that returns providers in Germany that require a form to be completed, but not a redirect, for payment authorisation. This is typically an embedded flow, where authorisation is completed through forms. For example, with the user providing their banking details and a one-time password through text fields.

{

"countries": [

"DE"

],

"currencies": [

"EUR"

],

"customer_segments": [

"corporate", "business", "retail"

],

"capabilities": {

"payments": {

"bank_transfer": {}

},

"mandates": {

"vrp_sweeping": {},

"vrp_commercial": {}

}

},

"authorization_flow": {

"configuration": {

"form": {

"input_types": [

"text", "text_with_image", "select"

]

},

"consent": {

"requirements": {

"pis": {},

"ais": {

"scopes": [

"accounts"

]

}

}

}

}

}

}{

"items": [

{

"id": "xs2a-targobank-de",

"display_name": "TargoBank Germany",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/icons/targo-bank.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/global/logos/targo-bank.svg",

"bg_color": "#4db4e8",

"country_code": "DE",

"swift_code": "CMCIDEDDXXX",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "public_beta",

"schemes": [

{

"id": "sepa_credit_transfer",

"requirements": [

{

"currencies": [

"EUR"

],

"account_identifier_types": [

"iban"

]

}

]

},

{

"id": "sepa_credit_transfer_instant",

"requirements": [

{

"currencies": [

"EUR"

],

"account_identifier_types": [

"iban"

]

}

]

}

]

}

}

}

},

{

"id": "xs2a-volksbanken-de",

"display_name": "Volksbanken Raiffeisenbanken",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/de/icons/volksbanken-raiffeisenbanken.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/de/logos/volksbanken-raiffeisenbanken.svg",

"bg_color": "#0066b3",

"country_code": "DE",

"swift_code": "GENODED1WTL",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "public_beta",

"schemes": [

{

"id": "sepa_credit_transfer",

"requirements": [

{

"currencies": [

"EUR"

],

"account_identifier_types": [

"iban"

]

},

{

"currencies": [

"EUR"

],

"account_identifier_types": [

"iban"

]

}

]

},

{

"id": "sepa_credit_transfer_instant",

"requirements": [

{

"currencies": [

"EUR"

],

"account_identifier_types": [

"iban"

]

},

{

"currencies": [

"EUR"

],

"account_identifier_types": [

"iban"

]

}

]

}

]

}

}

}

},

{

"id": "xs2a-deutschekredit-de",

"display_name": "DeutscheKredit Germany",

"icon_uri": "https://truelayer-provider-assets.s3.amazonaws.com/de/icons/deutsche-kredit-bank.svg",

"logo_uri": "https://truelayer-provider-assets.s3.amazonaws.com/de/logos/deutsche-kredit-bank.svg",

"bg_color": "#E6E6E6",

"country_code": "DE",

"swift_code": "BYLADEM1",

"capabilities": {

"payments": {

"bank_transfer": {

"release_channel": "public_beta",

"schemes": [

{

"id": "sepa_credit_transfer",

"requirements": [

{

"currencies": [

"EUR"

],

"account_identifier_types": [

"iban"

]

}

]

}

]

}

}

}

}

]

}Retrieve the details for a single provider

To retrieve the details and capabilities of a single provider, make a GET request to the v3/payment-providers/{id} endpoint. You must substitute the {id} path parameter with the id of the provider you want to retrieve details for.

The endpoint requires either an access_token with the payments scope or the resource_token.

To authenticate this request, you should use a payment (or mandate) access token.

{

"results": [

{

"provider_id": "ob-revolut",

"logo_url": "https://truelayer-provider-assets.s3.amazonaws.com/global/logos/revolut.svg",

"icon_url": "https://truelayer-provider-assets.s3.amazonaws.com/global/icons/revolut.svg",

"display_name": "Revolut",

"country": "GB",

"divisions": [

"retail"

],

"single_immediate_payment_schemes": [

{

"scheme_id": "faster_payments_service",

"fee_options": [

{

"fee_option_id": "string",

"beneficiary_fee": "free",

"remitter_fee": "free"

}

],

"requirements": "(Omitted from this example)"

}

],

"availability": {

"recommended_status": "healthy",

"error_rate": 0.5,

"updated_at": "2023-05-24T13:35:19.883Z"

}

}

]

}/v2/ vs /v3/ providers endpoints

/v2/ vs /v3/ providers endpointsWith the legacy Payments API v2, you could use the /v2/single-immediate-payments-providers endpoint to return a list of providers. Read the documentation for that endpoint in the legacy documentation section.

For all new integrations, or migrations, we recommend that you use the /v3/payment-providers/search endpoint.

This table explains how the /v2/ and /v3/ provider-related endpoints differ:

| v2 | v3 | |

|---|---|---|

| Endpoint | /v2/single-immediate-payments-providers | /v3/payment-providers/search |

| Request type | GET | POST |

| How the endpoint returns result | Returns all available providers by default, with extra parameters narrowing down the list. | Returns a smaller list of providers, with extra parameters increasing the list. |

| How you authenticate your request | Pass a client_id as a parameter within the request body. | Pass a valid access_token as a bearer header (no request signing necessary). |

Updated about 2 months ago